January 1 Tax Hikes to Strike Manitobans

- Manitoba still one of three provinces to not index personal income tax system for inflation; will cost taxpayers millions in 2013

- Higher CPP and EI rates will eat into paycheques as of Jan. 1

In its annual New Year’s Tax Changes report released today, the Canadian Taxpayers Federation (CTF) gave the federal and provincial governments a thumbs down for raising taxes once again in 2013.

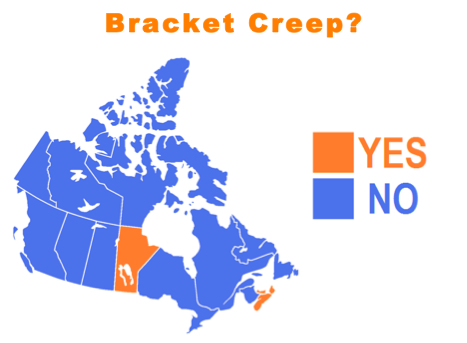

“Most people don’t know it, but Manitoba is one of three provinces that secretly increases personal income taxes each year through something known as bracket creep,” said CTF Prairie Director Colin Craig. “For instance, people paid the highest tax rate when their incomes hit $67,000 back in 2009. However, the high tax bracket is still $67,000 so as incomes grow, more and more are paying the highest tax rate. Most provinces protect their taxpayers by increasing their brackets for inflation.”

Bracket creep will cost taxpayers earning $45,000 an extra $11 in 2013, while those earning $80,000 per year will pay an extra $71 in bracket creep. However, if you look at the cumulative impact over the past decade, it’s even worst; it will cost individuals earning $45,000 per year more than $160 per year and those earning $75,000 more than $550.

In addition to “bracket creep,” Craig noted that CPP and EI premiums are also set to rise in 2013.

“CPP and EI premiums are also set to increase in 2013,” added Craig. “EI and CPP contributions are just like taxes as people have no choice but to pay them. The average Joe making $45,000 per year will pay an extra $84 in CPP and EI contributions.”

Canadian workers earning at least $47,400 will pay $891.12 in EI premiums in 2013, up $51.50. Employers will pay $1,247.57, an increase of $71.61.

Click here for details on payroll tax changes in 2013

Click here for 26 income and family scenarios on combined income and payroll tax changes in 2013